Expedia TAAP Mexico: What It Is, How to Register, and Benefits

Expedia TAAP Mexico could be the competitive advantage your agency is looking for. Discover how to register and how you can boost your income.

In several Latin American countries, access to the US dollar has become an everyday necessity—not only for saving but also for international transactions. However, the official exchange market sometimes has government-imposed restrictions, giving rise to alternatives like the blue dollar.

This phenomenon has become particularly popular in countries like Argentina, where it even has a daily unofficial exchange rate. However, Argentina isn’t the only country experiencing this.

So, what exactly is the blue dollar? What's the difference between the blue dollar and the regular dollar? In this guide, we’ll explain its origin, how it works, and why it persists in some Latin American countries.

The blue dollar is the currency bought and sold on the informal market, outside the official banking system. This allows people to evade taxes and currency regulations, making it fiscally illegal.

Because it operates outside the legal system, it typically trades significantly higher than the official exchange rate.

Why is the Blue Dollar More Expensive?

Even though it’s not governed by official mechanisms, its value fluctuates based on supply and demand. Additionally, economic perceptions and political factors heavily influence its price.

The concept originated in Argentina when the informal market emerged due to currency restrictions imposed by the government.

The term became widely used among the population and media around 2011, a period marked by economic crisis, inflation, and currency controls.

While this phenomenon has repeatedly occurred in Argentine history, Argentina isn’t alone in having a blue dollar.

Colombia, for example, has parallel markets that respond to similar situations. Hence, some people choose options outside the traditional banking system to buy dollars in Colombia.

In Brazil, Spain, Mexico, and other Latin American countries, the blue dollar has appeared as an alternative, although the term isn’t commonly used to refer to these parallel currency markets.

In some countries, it’s known as the black, parallel, or informal dollar. However, the term "blue dollar" became popular in Argentina to denote the unofficial US dollar.

There's no official explanation for the origin of the term. Some popular theories include:

Color of the Bills: One theory suggests the term refers to the bluish hue of older $100 bills.

Association with Illegality: Another theory is that in English, "blue" relates to something dark or illegal, similar to "blue movies" (banned films), suggesting it's an activity not regulated by the state.

Financial Jargon: Some colors in finance differentiate formal and informal markets, possibly making "blue" a chosen contrast to the official market.

Additionally, some speculate the name "blue dollar" arose due to the circulation of counterfeit bills in this market. While the exact origin is uncertain, the term solidified in Argentina starting around 2011.

The main difference between the blue dollar and the official dollar is where and how each is obtained, along with their exchange rate values.

Simply put, the official dollar is legal but limited. In contrast, the blue dollar is illegal but more accessible for those unable to purchase through formal markets.

Now, if you want to buy dollars in Mexico at cheap prices and safely, you must go through the channels regulated by the State. Such as banks or agencies authorized to exchange foreign currency.

Otherwise, you can obtain the blue dollar on the streets through unregistered intermediaries. Naturally, this will come with higher prices and increased risks.

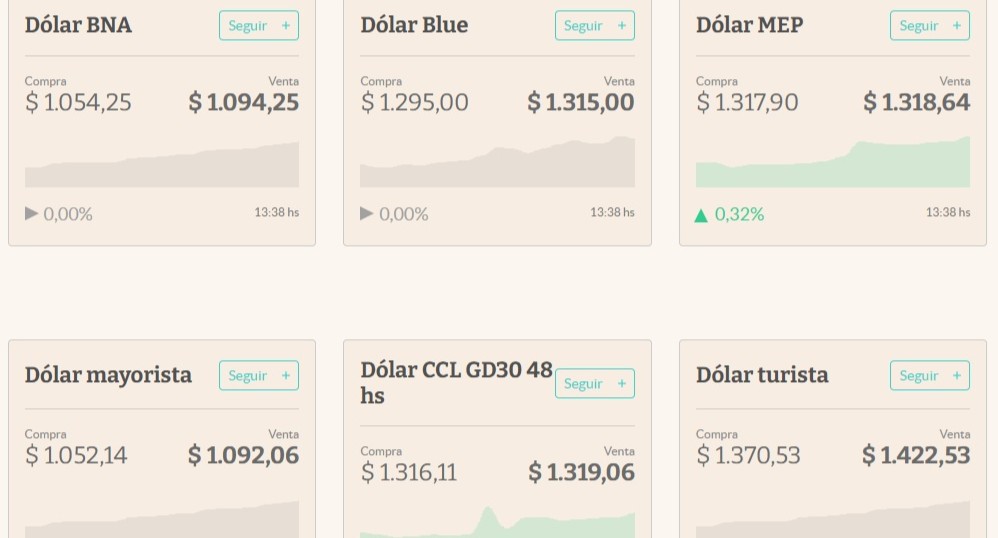

Prices taken on April 3, 2025, from El Cronista.

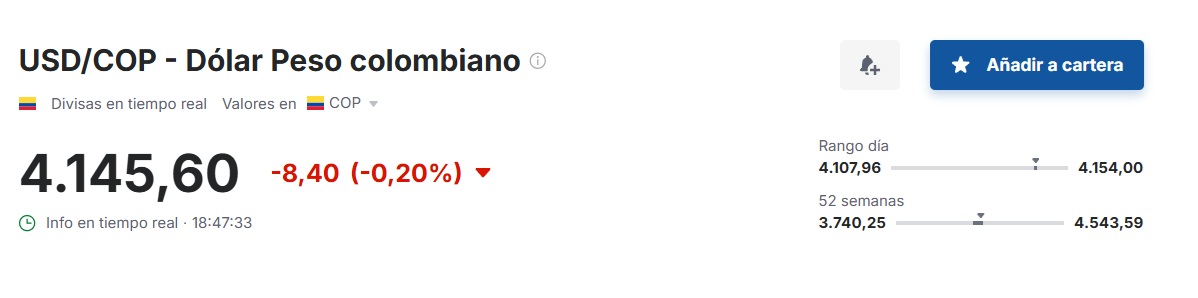

Prices taken on April 3, 2025, from Investing.

Argentina manages several dollar rates:

Prices taken on April 3, 2025, from El Cronista.

Economic instability is a primary reason behind the emergence of parallel markets. Local currency devaluation pushes people to seek alternatives to protect savings or conduct transactions. Companies also increasingly operate outside official systems.

Common causes include:

Currency controls limiting or raising costs of foreign exchange through official channels.

Distrust in economic policies.

High inflation rates causing economic uncertainty.

Political instability.

The informal dollar market responds to a genuine societal need in such environments, reflecting distrust in local currency and economic policies.

Currency controls and restrictions on incoming foreign exchange impact many people. Even those receiving remittances often turn to the parallel market for better exchange rates.

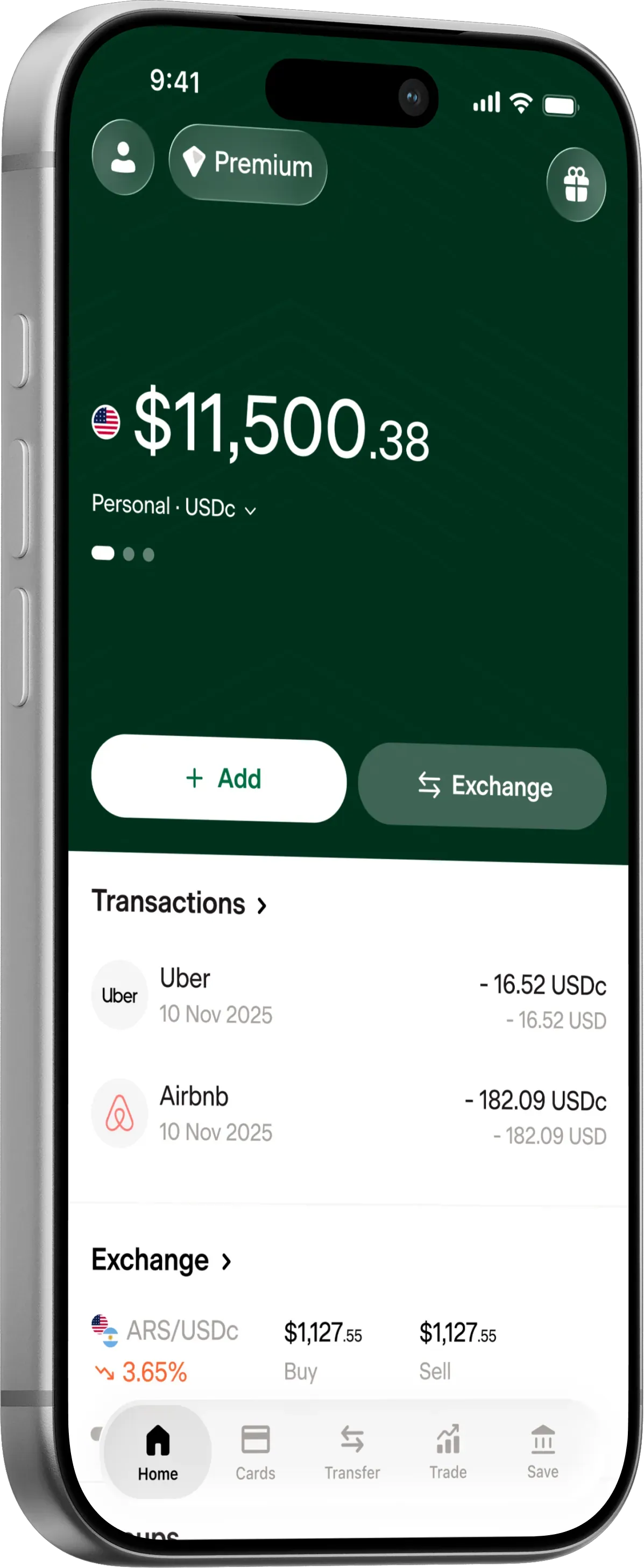

However, informal agencies might charge hidden fees, but with DolarApp, you avoid this issue.

We provide a real-time updated exchange rate, allowing you to buy or sell digital dollars while viewing current rates beforehand.

Additionally, there are no conversion fees, and the exchange rate applied has no hidden costs. Simultaneously, you can protect your money against local currency devaluation, making it an ideal solution for receiving international payments.

Conectando seu dinheiro às maiores oportunidades do mundo.

Expedia TAAP Mexico could be the competitive advantage your agency is looking for. Discover how to register and how you can boost your income.

Expedia Flights Mexico and its loyalty program are exactly what you need to save money. Discover how to book cheaply and the benefits of Expedia Rewards.

Applying for a U.S. visa for the first time in Mexico involves more than just filling out a form, whether for tourism or business. All the details are here.